For those of you who don’t know, the gold to silver ratio is simply the amount of silver it takes to buy one ounce of gold. This ratio is used by investors as a way of determining which metal is undervalued and which is overvalued.

Typically, when the gold to silver ratio is high, it means that silver is undervalued and is a good time to buy silver. When the ratio is low, it means that gold is undervalued and is a good time to buy gold.

How the Gold to Silver Ratio Is Calculated

The gold to silver ratio is calculated by dividing the price of one ounce of gold by the price of one ounce of silver

For example, at the time of this writing gold is currently selling for $1,700 per ounce and silver is selling for $21 per ounce. To calculate the ratio, we would simply divide 1,700 by 21 which would give us a ratio of approximately 81.

This means that it would take 81 ounces of silver to buy one ounce of gold.

What Does the Gold to Silver Ratio Mean?

Now that you know how the ratio is calculated, you’re probably wondering what it actually means. As we said before, the ratio is used by investors as a way of determining which metal is undervalued and which metal is overvalued.

Generally speaking, a high ratio indicates that silver is undervalued while a low ratio indicates that gold is undervalued. However, there are a few other things that you should keep in mind when interpreting the ratio.

For example, if the gold to silver ratio has been steadily climbing for months or even years, it could mean that there’s more demand for gold than there is for silver. On the other hand, if the ratio has been steadily declining over time, it could mean that there’s more demand for silver than there currently is for gold.

The History of the Gold to Silver Ratio

The Gold to Silver ratio hasn’t always be free floating. In fact, the measurement dates back all the way to 3200 BC when King Menes (of Ancient Egypt), set the ratio to 2.5 to 1. Imagine buying gold today for the price of 2.5 ounces of silver! Needless to say, it didn’t take long for that fixed ratio to go out the window, as the demand for gold steadily outpaced silver.1

Over the years the ratio has been fixed several times by various governments around the world. Ancient Rome set at 8:1 in 210 BC. Julius Ceasar increased that to 8:1 and by the time of Augustus, it had been raised to 11.75:1.

The US Government got involved with the Coinage Act of 1792, and set the ratio to 15.5:1, in an effort to secure the value and consistency of US coinage. Again, the fixed ratio didn’t last long in the face of global industrialization as well as the conflicts of World War 1 and World War 2. These events caused the major volatility in both precious metals and currencies. Consequently, the ratio surged from 40:1 to as high as 100:1!1

The Modern Era of the Gold to Silver Ratio

The 21st Century has continued to see some wild volatility in the ratio. The global pandemic caused unprecedented uncertainty in the financial markets around the world…ultimately causing the ratio to reach 123:1. It has since leveled off, but we are just now starting to see the consequences of our reckless monetary policy and handouts. The financial markets are on thin ice and precious metals are back on the rise as people look to protect their money from the ravages of inflation!

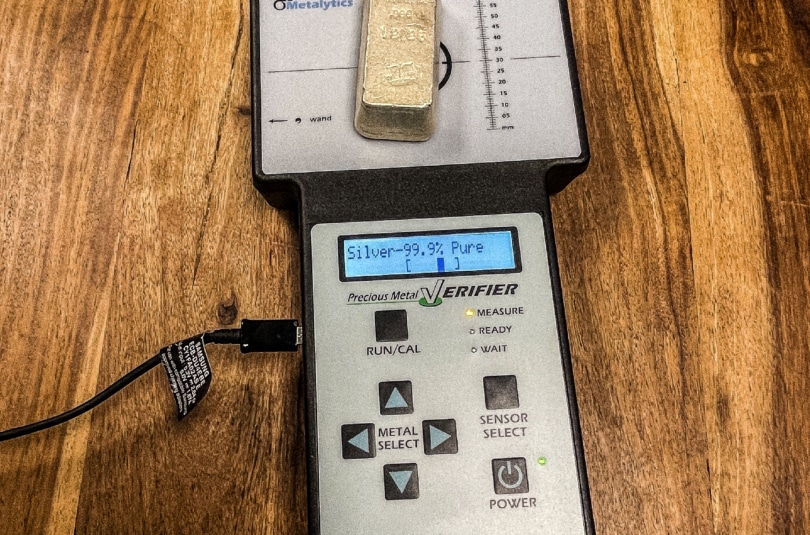

As an investor, it’s important to be aware of the current state of the market and how different factors can affect the price of precious metals. The gold to silver ratio is one such factor and by understanding how it works, you’ll be better equipped to make investment decisions accordingly. You can use it to help guide your investment allocation of gold or silver bars!

1. https://elements.visualcapitalist.com/charting-the-gold-to-silver-ratio-over-200-years/